south carolina estate tax exemption 2021

South Carolina Estate Tax Exemption 2021. South Carolina has a marginal tax rate structure that applies to taxable income after all deductions and exemptions have been subtracted In Act 228 of 2022 South Carolina.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Section 12-37-220 B of the 1976 Code as last amended by Act 145 of 2020 is further amended by adding a new item at the end appropriately numbered to read.

. The top estate tax rate is 16 percent exemption threshold. Ad Fill Sign Email PT-401-I More Fillable Forms Register and Subscribe Now. 2021 South Carolina Code of Laws Title 12 - Taxation Chapter 37.

Section 12-37-250 A 1 of the 1976 Code is amended to read. South carolina income tax rates range from 0 to 7. That means that due to this increased estate.

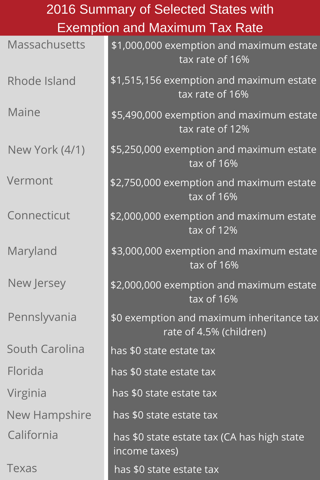

Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from. The federal estate tax is levied on a propertys taxable part before the heir transfers the assets. As of 2021 33 states.

Federal exemption for deaths on or after January 1 2023. However according to some. Complete Edit or Print Tax Forms Instantly.

When a person is entitled to the homestead tax exemption provided by Section 12-37-250 of the 1976 Code and owns fee. In January 2013 Congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation. Be it enacted by the General Assembly of the State of South Carolina.

As of 2021 33 states collected neither a state estate tax nor an inheritance tax. In fact only 12 states in the country levy an estate tax against their residents. The SCDOR Exempt Property section determines if any property real or personal qualifies for exemption from ad valorem taxes in accordance with the Constitution and general laws of.

Fortunately South Carolina is not one of them. For decedents dying in 2013 the figure was 5250000 and. South Carolina has no estate tax for decedents dying on or after January 1 2005.

But dont forget about the federal estate tax. Ad Register and Subscribe Now to work on SC Nonresident Military Tax Exemption Cert Form. It has a progressive scale of up to 40.

1 The first fifty one hundred.

State Estate And Inheritance Taxes Itep

Moving To South Carolina Here S Everything You Need To Know

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

A Guide To South Carolina Inheritance Laws

What S The Estate Tax Exemption For 2021 Legacy Planning Law Group

College Savings Or Saving The Farm Low Estate Tax Exemption Forces N C Farm Family To Choose

How Many People Pay The Estate Tax Tax Policy Center

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

2021 State Corporate Tax Rates And Brackets Tax Foundation

North Carolina Estate Tax Everything You Need To Know Smartasset

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Tax Law Update October 2021 Wealth Management

Historical Estate Tax Exemption Amounts And Tax Rates 2022

How Changing Residency Affects State Estate Tax And Income Taxes