texas estate tax exemption

Death taxes consisting of inheritance and estate taxes are also non-existent. In the past year there were proposals to reduce the estate tax exemptionmeaning lowering the amount after which individuals will need to pay a tax on their estate.

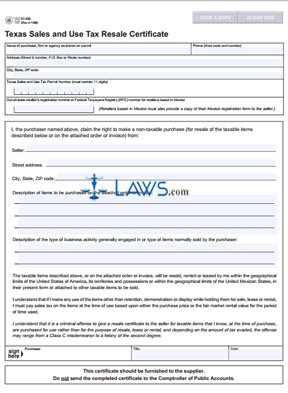

Free Form 01 339 Texas Sales And Use Tax Exemption Certification Free Legal Forms Laws Com

1090 disabled veterans of all ages.

. Seniors older than 65 or disabled residents. For questions about property taxes and ad valorem taxes call our Property Tax Assistance Division at. In 2022 the unified credit will increase to 12060000.

Although they are not common there are a few other Texas property tax exemptions that might apply to your situation. However the Tax Code allows applications for certain exemptions to be filed after the deadline has passed. The local option exemption cannot be less than 5000.

2022 Lifetime Estate and Gift Tax Exemption. Property tax brings in the most money of all taxes available to local governments to pay for schools roads police and firemen emergency response services libraries parks and other services provided by local. The deadline for filing an exemption is April 30.

Other Property Tax Exemptions in Texas. If a county collects a special tax for farm-to-market roads or flood control a residence homestead owner is allowed a 3000 exemption for this tax. In 2015 the City Council approved a tax.

The exemption will be added to the existing 25000 homestead exemption. 1 day agoProperty tax decreases in the form of tax exemptions are reductions and savings to your tax bill. Taxation has to be equal and uniform.

Get your free copy of The 15-Minute Financial Plan from Fisher Investments. The Breakdown of Taxes in Texas. Any estate that exceeds these thresholds is subject to the federal estate-tax of 40.

The Texas Tax Code Section 3306 allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death. While the increase itself is notable what may be more important is the fact that the credit is currently expected to be cut in half for 2026. 1 You must ownoccupy your home.

1 Lease--An agreement other than a rental as defined by Tax Code 152001 5 whereby an owner of a motor. Texas repealed its inheritance tax in 2015 and has no estate taxes either. If you have questions or need information on applying for an exemption from the Texas franchise tax sales tax or hotel occupancy tax please call 800-252-5555.

Many cities counties and other taxing units may also offer additional exemptions of at least 3000 for homeowners 65 or older. In Texas the federal estate tax limits apply. In 2018 the thresholds for a single persons Texas estate tax were estimated to be 58 million and 112 million for a married couple.

Disability exemption for veterans. The Texas Constitution uses these five rules for property taxes. Property tax in Texas is a locally assessed and locally administered tax.

Here are examples of what exemptions you could combine. This exemption carries over to spouses of deceased property owners as long as the property owner was at least 65 and the spouse is at least 55. However they do have the option of applying for a tax ceiling exemption which will freeze the amount of property taxes paid to the school district.

3 You must be a United States citizen you must have lived in the State of Texas for the past year and you must be 18 years or older. 100 disabled veterans of all agesprimary residence homestead exemption only. Reduction to the Estate Tax Exemption.

To meet the ownership requirements you must own the home. This rate can go up to 075 for non-exempt businesses. The second proposition for exemptions that will lower appraised values on residences passed with 83 percent of 1333434 voters casting ballots in its favor.

All school districts in Texas grant a 10000 exemption for qualifying homeowners aged 65 or older. The following words and terms when used in this section shall have the following meanings unless the context clearly indicates otherwise. 12000 from the propertys value.

Tax Code Section 1113 b requires school districts to provide a 40000 exemption on a residence homestead and Tax Code Section 1113 n allows any taxing unit to adopt a local option residence homestead exemption of up to 20 percent of a propertys appraised value. It is also important to remember that Texass threshold is higher than. Texas Estate Planning and Cryptocurrency July 10 2022.

Totally blind in one. The measure which will cost the. To receive the 100 percent disabled veteran exemption you may file for the exemption up to five years after the delinquency date for the taxes on the property.

Property Tax Exemption for Certain Leased Motor Vehicles. In Texas a property owner over the age of 65 cant freeze all property taxes. Ad Get free estate planning strategies.

According to Tax Code Section 1127 you may qualify for a Texas property tax exemption if you have a solar or wind-powered energy device installed on your property. The value of your property is the basis of the property taxes you pay. Every property should pay its fair share.

Before applying for either you must first meet the following criteria. A disabled veteran may also qualify for an exemption of 12000 of the assessed value of the property if the veteran is age 65 or older with a disability rating of at least 10 percent. Texas has no income taxes but it levies a franchise tax of 0375 on wholesalers and retailers.

If the county grants an. Disability exemption for veterans. B Land owned by the Permanent University Fund is taxable for county purposes.

If you are a Texas resident with an estate to protect then do not hesitate to contact the. 1090 disabled veterans over 65 years of age. There is no state property tax.

This exemption will be added to the standard 25000 homestead exemption you qualify for. A Except as provided by Subsections b and c of this section property owned by this state or a political subdivision of this state is exempt from taxation if the property is used for public purposes. EXEMPTIONS FOR ATVS AND OFF-ROAD VEHICLES.

SENIOR TAX EXEMPTION. The primary residence of the applicant. Eligible seniors will get a 10000 exemption for school district property taxes.

All residence homestead owners are allowed a 40000 residence homestead exemption from their homes value for school district taxes. This freeze amount is based on the year the individual qualified for the 65 or older exemption and can. If you own a ranch and you are age 65 or older you qualify for this exemption as long as you live in a house on the property.

Dont leave your 500K legacy to the government. 2 Your home must be located in Texas. The tax deferment like a homestead exemption is available to qualified homeowners free of charge.

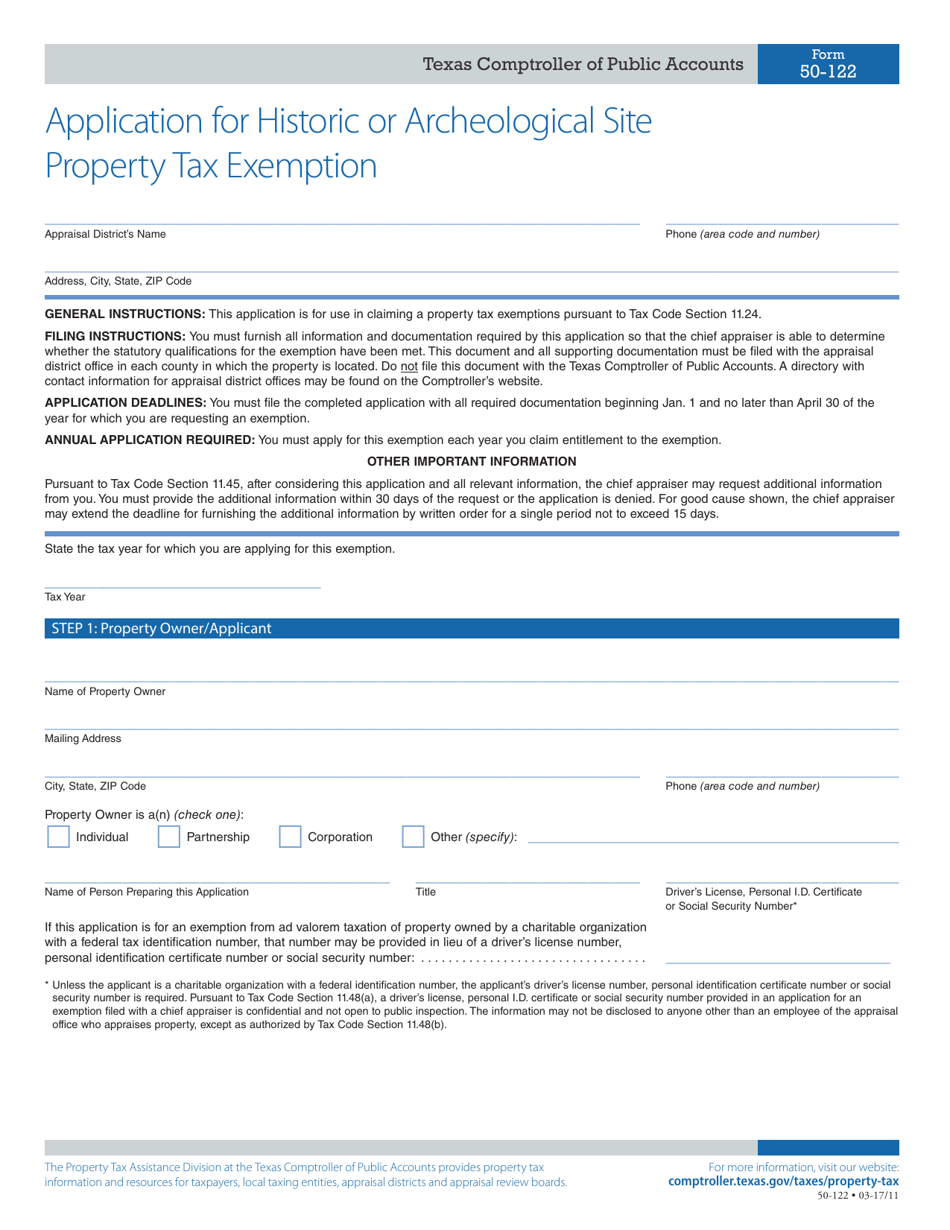

Form 50 122 Download Fillable Pdf Or Fill Online Application For Historic Or Archeological Site Property Tax Exemption Texas Templateroller

Is There An Inheritance Tax In Texas

Texas Homestead Tax Exemption Cedar Park Texas Living

Title Tip Another Legislative Update For Texas Homeowners Candysdirt Com

States With No Estate Tax Or Inheritance Tax Plan Where You Die

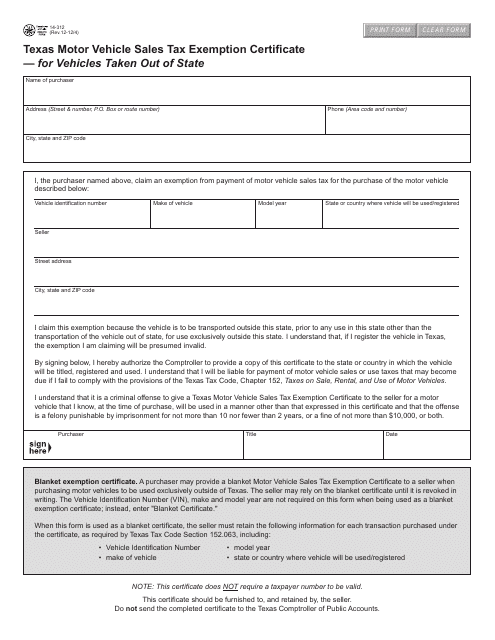

Form 14 312 Download Fillable Pdf Or Fill Online Texas Motor Vehicle Sales Tax Exemption Certificate For Vehicles Taken Out Of State Texas Templateroller

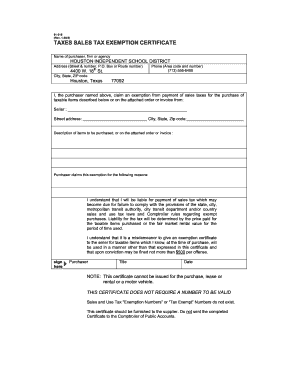

Texas Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Qualifying Trusts For Property Tax Homestead Exemption Sprouse Shrader Smith

Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Texas Tax Exempt Certificate Fill And Sign Printable Template Online Us Legal Forms

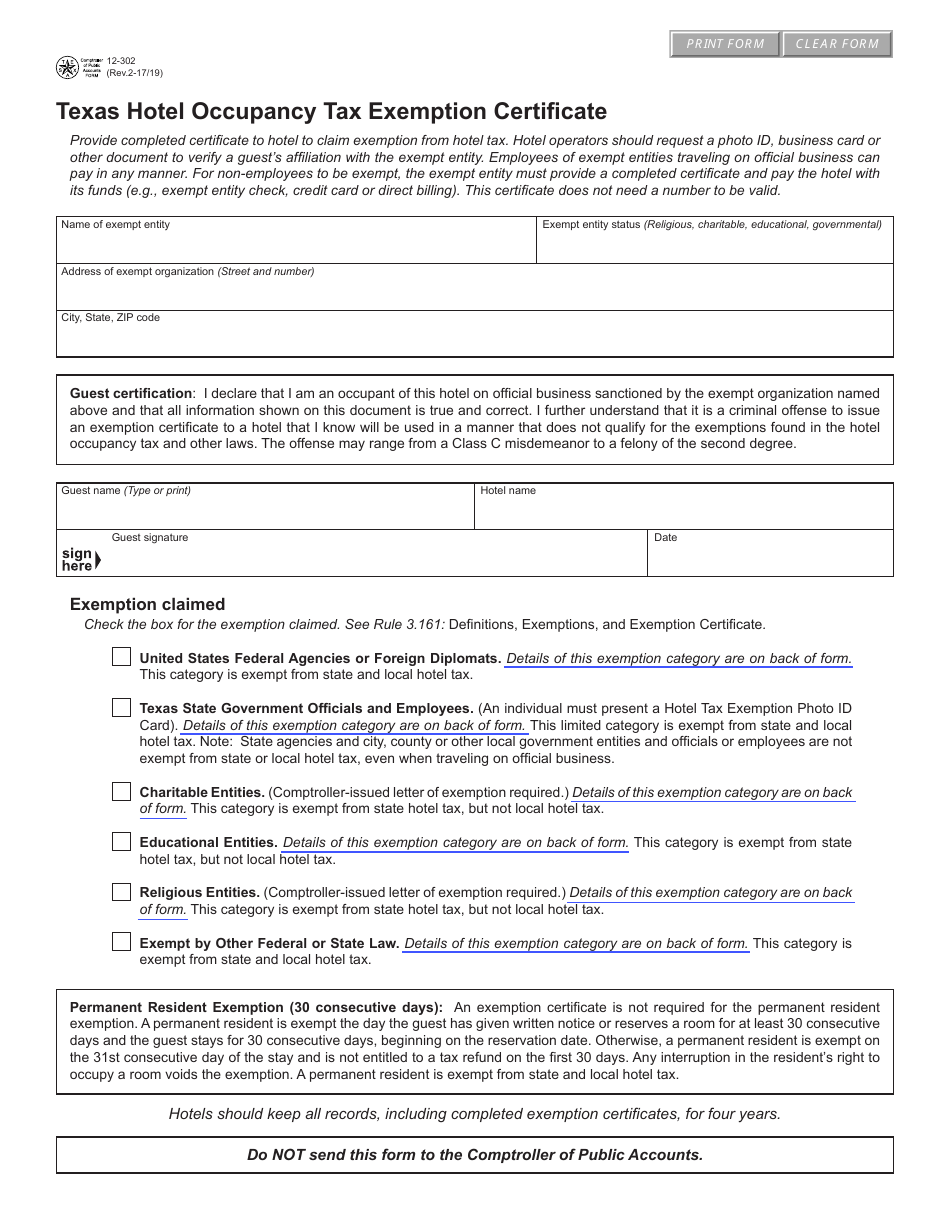

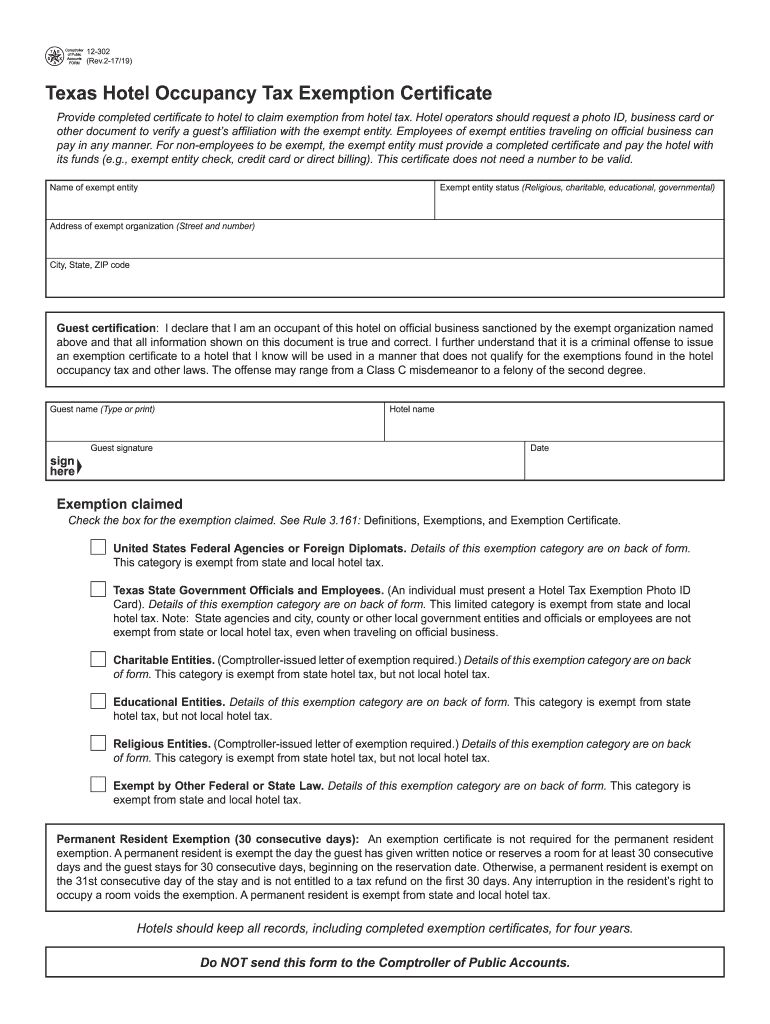

Form 12 302 Download Fillable Pdf Or Fill Online Hotel Occupancy Tax Exemption Certificate Texas Templateroller

Texas Inheritance And Estate Taxes Ibekwe Law

Tx Comptroller 01 924 2017 2022 Fill Out Tax Template Online Us Legal Forms

Property Taxes Texas National Title

Tx Comptroller 12 302 2017 2022 Fill Out Tax Template Online Us Legal Forms

Tx Comptroller 01 315 1991 2022 Fill Out Tax Template Online Us Legal Forms